The future of fintech is reshaping the global financial landscape, challenging traditional banking institutions, and introducing faster, more customer-centric solutions. As technology continues to evolve, financial services are becoming more digitized, decentralized, and data-driven. From mobile banking apps to blockchain technology, fintech is setting the new standard for how we interact with money.

The Shift from Traditional Banking to Digital Innovation

Traditional banks, known for their conservative operations and in-person interactions, are now under pressure from agile, tech-powered startups offering smarter alternatives. These emerging financial technology trends are disrupting age-old banking models and replacing them with services that are more efficient, accessible, and customer-focused.

At the heart of this disruption is convenience. Consumers today expect financial transactions to be as simple as ordering food or booking a cab. Mobile banking apps and digital wallets offer 24/7 access to services once limited to banking hours. This shift is not only transforming customer behavior but also compelling legacy banks to adopt digital strategies or risk falling behind.

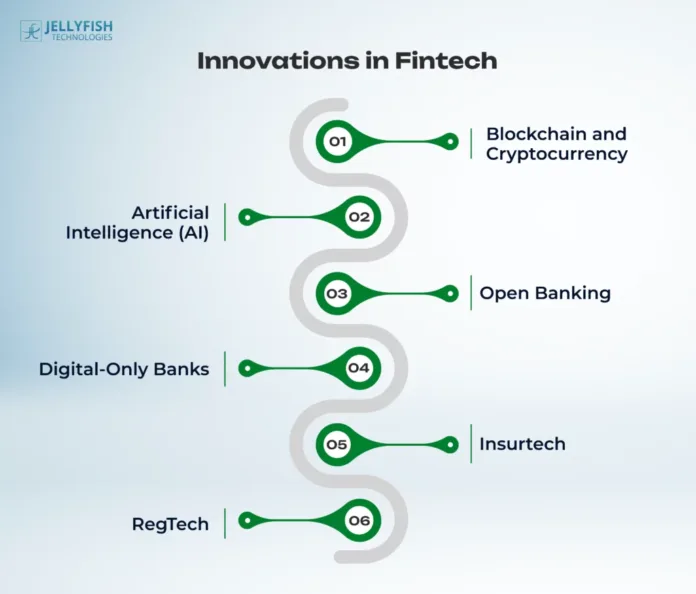

Key Innovations Driving the Fintech Revolution

Mobile Banking Apps

Smartphones are now virtual banks. Users can check balances, transfer funds, apply for loans, and invest—all from a mobile interface. The rise of user-friendly apps is giving consumers more control over their finances than ever before.Blockchain in Finance

The use of blockchain technology is one of the most groundbreaking changes in the financial sector. It ensures secure, transparent transactions without the need for intermediaries, lowering costs and reducing fraud risks.AI and Machine Learning

Artificial Intelligence is being used to detect fraudulent activities, personalize financial recommendations, and streamline operations. Machine learning algorithms analyze spending behavior to offer smarter budgeting tools and financial insights.Neobanks

These digital-only banks operate without physical branches and offer low-cost banking services through apps. They cater especially to tech-savvy customers and the unbanked population in emerging markets.Robo-Advisors

Robo-advisors are transforming wealth management by using algorithms to provide personalized investment advice with lower fees than traditional financial advisors.

Challenges Faced by Traditional Banks

The future of fintech brings along challenges for conventional financial institutions. Legacy banks face technological inertia, rigid regulations, and the inability to innovate quickly. Many still rely on outdated systems that are costly to maintain and difficult to upgrade. In contrast, fintech startups operate with modern infrastructure, allowing them to adapt swiftly to market needs.

Moreover, customer loyalty is shifting. People are now willing to trust new financial platforms over traditional banks, especially younger generations who value digital-first experiences.

Regulatory Landscape and Cybersecurity

As fintech grows, so does the need for robust regulatory frameworks. Governments are now working to balance innovation with consumer protection. Cybersecurity is also a primary concern. With the digitization of money, fintech firms must invest heavily in encryption, biometric authentication, and fraud detection technologies to maintain user trust.

What the Future Holds for Fintech

Looking ahead, the future of fintech will likely feature even more decentralized finance (DeFi) solutions, real-time payment systems, and AI-driven financial assistants. Traditional banks must evolve or collaborate with fintech companies to stay competitive. Partnerships, mergers, and acquisitions between banks and startups are already becoming common.

The focus will also shift toward financial inclusion. Fintech has the potential to bring banking services to underserved populations, breaking geographical and economic barriers.

Conclusion

The future of fintech is dynamic and full of possibilities. It’s not just about disrupting traditional banking—it’s about creating a smarter, faster, and more inclusive financial ecosystem. As technologies continue to develop, the gap between what traditional banking offers and what modern consumers expect will only widen. To stay relevant, banks must embrace innovation and reimagine the customer experience from the ground up.